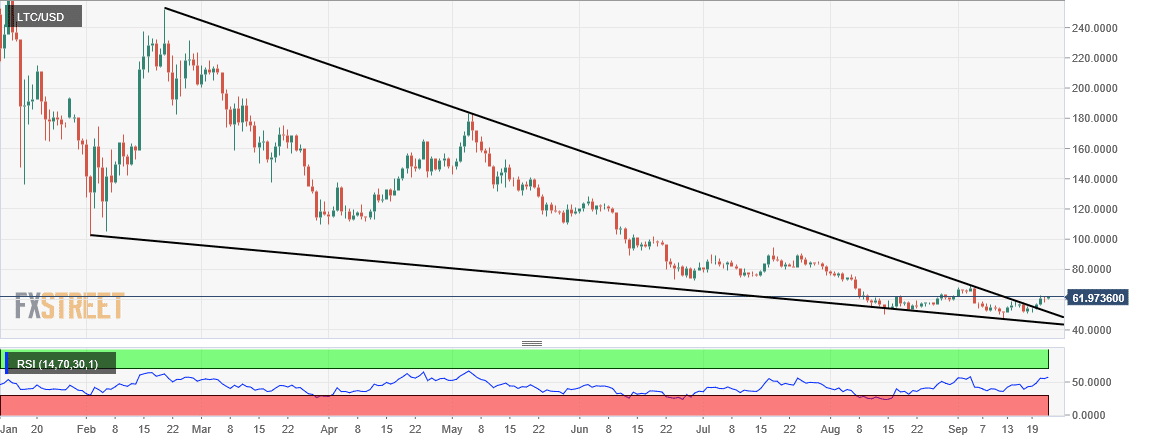

As you can see from the first picture, the top and the bottom lines are providing resistance and support respectively.

You can start trading a wedge or a triangle while it is being formed. In the images below you can see a triangle and a wedge being formed. In a wedge, the price breaks out in either direction before the two trend lines meet. As the name indicates, a triangle is formed when the top and the bottom trend lines culminate in a single point, confining the price in between them. If you are trading 1-hour charts, when the consolidation begins to take place change to 5 or 15-minute charts and draw a trend line connecting the tops and another one connecting the bottoms of the price range during that consolidation.

In order to have a better view, you should change the charts to a smaller time frame. In an uptrend, the first leg goes up and then consolidates before starting the second leg, and vice versa for the downtrend.ĭuring the consolidation period, the price forms a triangle or a wedge. Instead, it forms trends following different types of waves, as we have explained in the “Elliot Wave Strategy”. It´s true that they are different patterns, but they are very similar so we´ll teach both of them in one article.Īpart from special occasions which are very rare, we all know that the price doesn´t go up or down in a straight line.

DESCENDING WEDGE HOW TO

“Triangles” and “Wedges” are two of the 10 most important chart patterns and in this article we´ll explain how to trade them. There are still some strategies left though. We have covered most of the important technical chart patterns in our strategy section.

0 kommentar(er)

0 kommentar(er)